- In the whole crypto market, we have seen that it has captivated the hearts and minds of individuals worldwide.

- Navigating the dynamic landscape always requires a careful approach and a well-crafted strategy.

Nowadays, you all must have noticed that numerous cryptocurrencies that are interested in trading are coming into the market. Before investing or trading in cryptocurrencies, you need to make sure that you find the right cryptocurrency trading strategy if you are the one who is looking for high profits and not losses.

What are the different types of trading strategies?

We all know that Cryptocurrency trading strategies are important in navigating the volatile and dynamic market. Just to capitalize on the price movements, some traders employ various approaches by taking risks and maximizing profit. Now, you will come across various trading strategies which will help you in many ways,

- Scalping

This is one of the high-frequency trading strategies where different types and kinds of traders always aim to generate profit from very small price differentials. Also, multiple traders used to trade in multiple succession by capitalizing on very short-lived opportunities. Advanced technical analysis and a deep understanding of the market are always required in this strategy.

- Arbitrage

This is the second strategy which eventually involves exploiting price discrepancies that too between Cryptocurrency exchanges or other markets. You need to always make sure that traders simultaneously buy an asset at a very low price in one market and later sell it at a very high price which is sometimes unexpected. Access to multiple exchanges, quick execution, along efficient fund transfers os required in this strategy.

- HODL (Hold on for Dear Life)

Yes, this is the third strategy if you plan for a long-term investment. Here you will find that the traders buy cryptocurrencies and later hold them for extended periods. Belief in long-term potential is the only base for this strategy and the value appreciation for chosen cryptocurrencies.

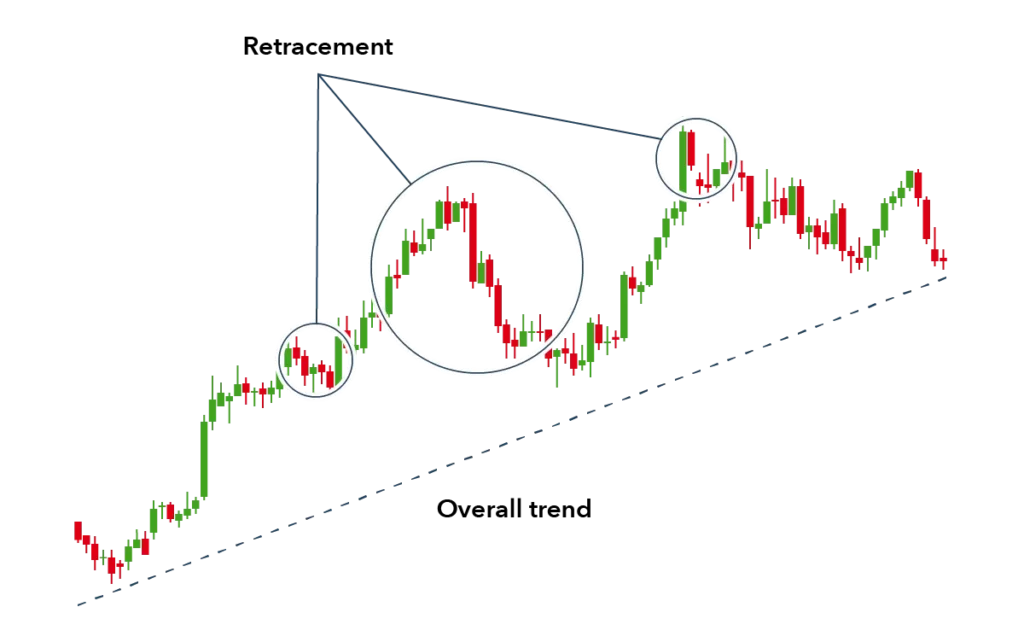

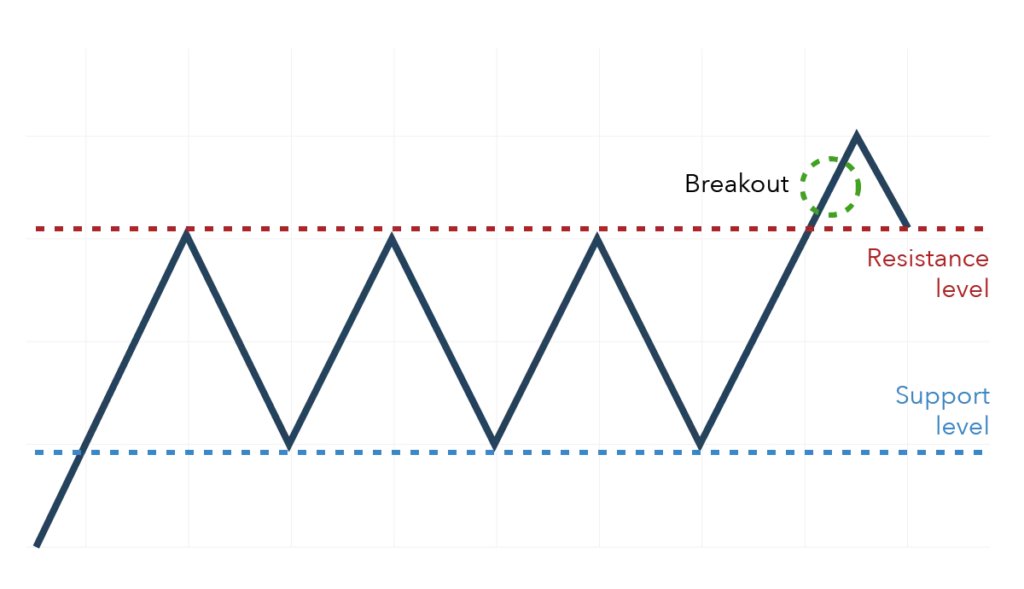

- Technical Analysis Strategy

Studying historical price data is involved in the technical analysis along with some patterns and indicators while making trade decisions. Traders and investors can easily analyze price charts by identifying the support and resistance levels. When trading, we all know a risk is involved, but you should know how to deal with that risk.

If you are eagerly waiting to start investing and become an investor or a trader, let me tell you that there are many more strategies that can also be identified from the whole crypto market.

When consistently investing or trading, you will also understand that developing a robust risk management strategy is crucial. The reason behind this is developing very comprehensive risk management can sometimes be helpful for safeguarding your investments by navigating the volatile nature of this digital currency ecosystem.

Risk management is also one of the most dynamic processes requiring ongoing monitoring and adjustments just to adapt to the changing market trends. Media can also be the biggest presence in the world of cryptocurrencies as it can exchange and also impact the markets.